税务倒置

1.什么是税务倒置

税务倒置又叫税收倒置或税负倒置 ,是指企业通过改变注册地的方式(由高税率国家迁往低税率国家),将原本应适用的比较高的税率变为适用比较抵的税率,以达到避税的目的。此外税务倒置也可通过海外并购后的业务转移来完成。

2.税负倒置避税具体是怎么操作的?[1]

由于:

"The United States taxes

domestic companies on their world-wide income, while most other countries tax

their domestic companies only on domestically-earned income. This means that

U.S. companies are ensured of facing a marginal tax rate of at least 35 percent

on every dollar earned whether earned domestically or abroad. The Internal

Revenue Code does allow for the deduction of some foreign-earned income from

taxable income through a series of complex rules and regulations. However, the

compliance costs associated with taking advantage of these allowances are

extremely high." http://--taxfoundation.org

所以企业们可以这样降低税率:

"The practice started with US-based companies

establishing entities in a low tax jurisdiction which would then become the parent

company of the existing US-based corporate group. By doing this, foreign income would

be kept out of the scope of the US tax system and in some cases tax liabilities on domestic

earnings could be lowered as well, though income earned in the US is still generally

subject to US tax regardless of where the parent company is based." --Goldman Sachs

这叫作tax inversion

3.利用并购来追求税负倒置的情况为何现在越来越普遍?[1]

比较好奇的是如果这个方法是可行性非常高的,为什么以往没有被经常使用呢?而是最近两年变的很平常?如果税负倒置可以避税,为何今年(2014年)才做?

这几个问题其实就是一个问题,答案是很早就有了.

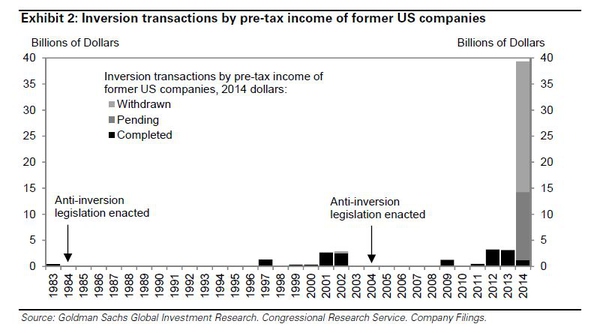

至于今年为什么这么多,一张图回答你问题:

01年02年有上升趋势,结果马上04年颁布Anti-inversion legislation,然后07,08根本没心思考虑这事, 10年欧洲又危机。最近revenue渐渐回来了所以又开始了

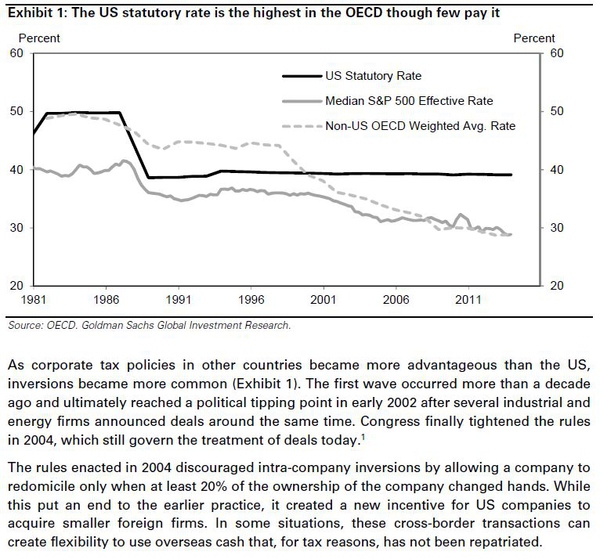

再解释一下内在动机以及04年的新规定到底是什么, 可以看到最近税率差距越来越大:

资料全部来自于Goldman Sachs Economics Research。